10

Dec

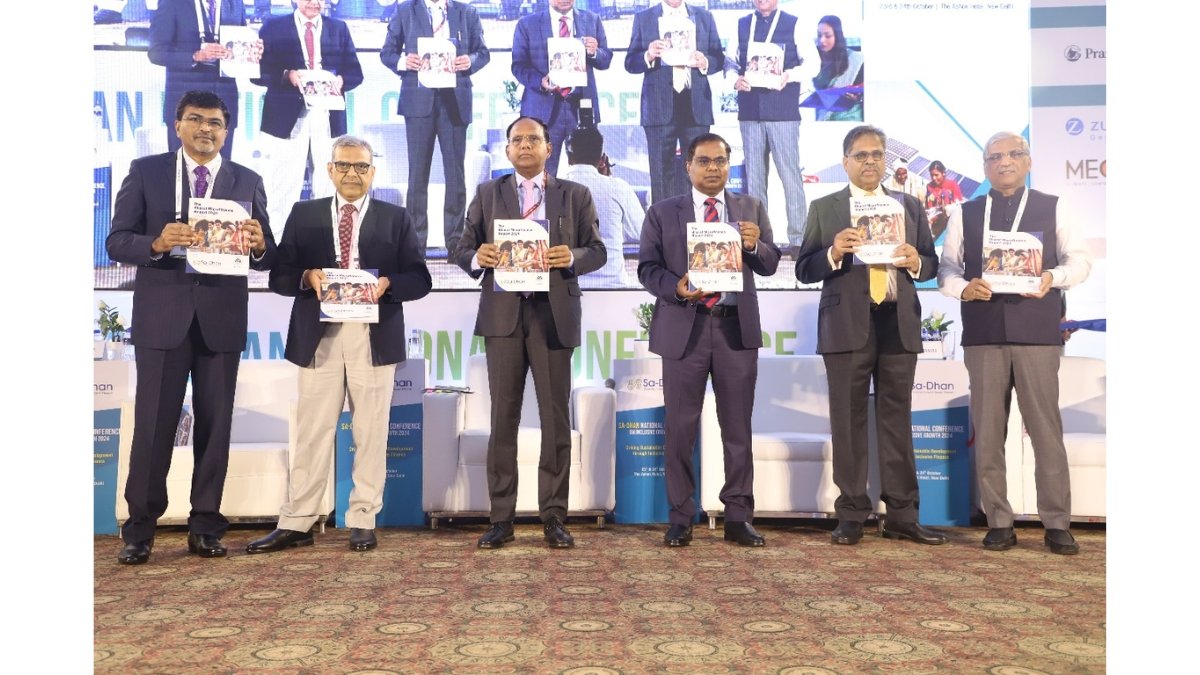

New Delhi [India], December 10: Annapurna Finance Private Limited (AFPL), a leading Micro & SME Finance institution in India, has raised $109.5 million through a multilateral syndicated social loan facility under the External Commercial Borrowing (ECB) framework. The transaction was exclusively arranged by Standard Chartered Bank (SCB). The facility involved 10 reputed financial institutions from South East Asia, Middle East, and Africa. It was structured under a Social Financing framework which was reviewed and validated by S&P Global, supporting Annapurna’s focus on financial inclusion. There is a green-shoe option to raise an additional $40 million apart from the above-mentioned amount. Funds to Support Rural and Underserved Communities.…